I am interested in the recent rally in S&P500 and drop in the dollar index.

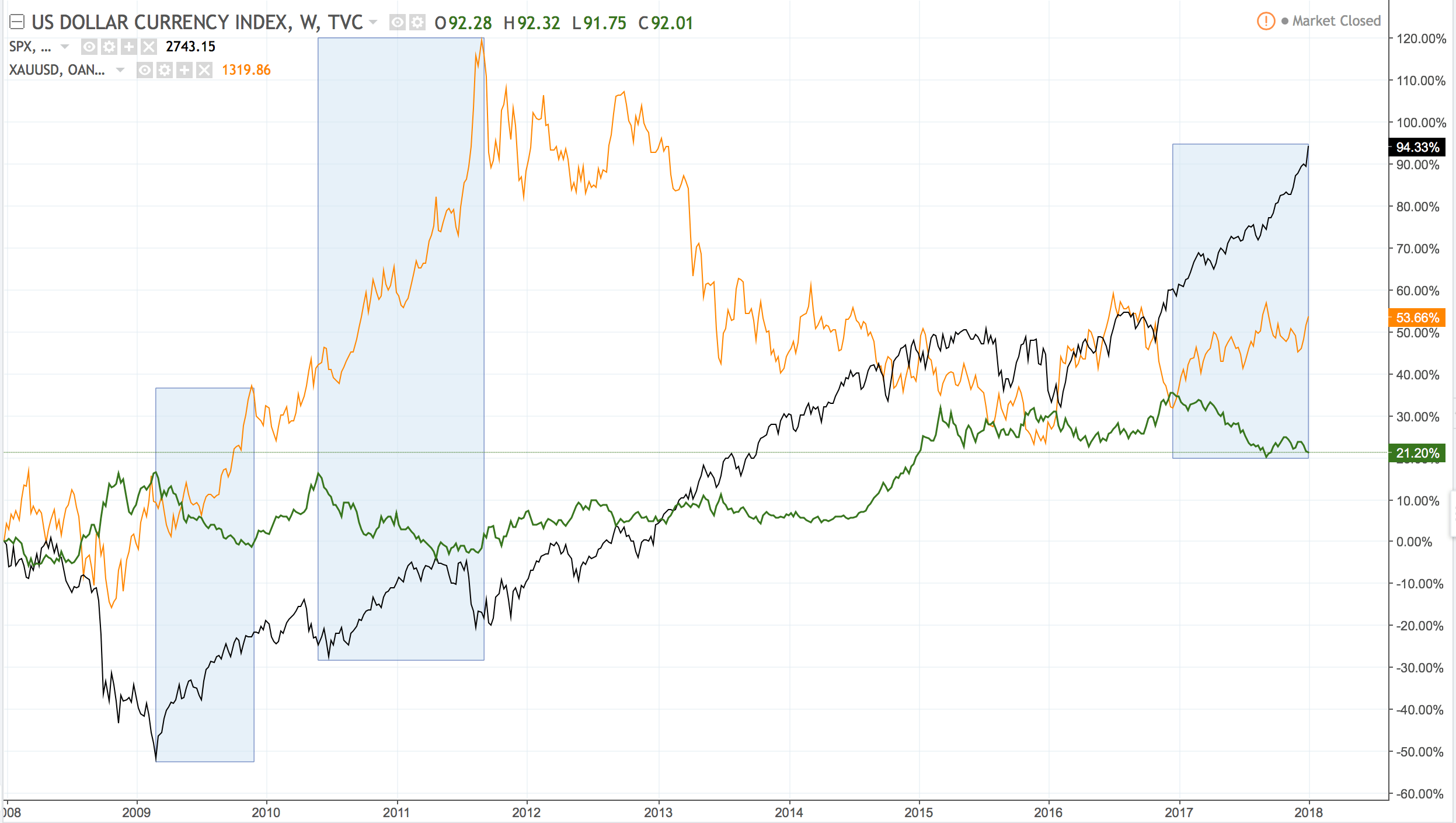

Below is a Weekly price chart which compares between Dollar index (green line), Gold (yellow line) and S&P500 (black line) in period 2008 – 2018 January.

Above shows three highlighted rectangle box which dollar index drop. You can see the gold and S&P rise either one or both of them rally. Why does this happen? Any fundamental or reason behind?

I was forming all my following view by refer to a few reference links.

Do Stocks Rise When the Dollar Falls? and Bitcoin Mastermind discussion

It said, that “A strong dollar is synonymous with falling equity prices, while a weaker dollar can cause stock prices to rise.”.

Natural attribute of USD dollar:

Safe-haven: Investor tends to keep dollar during the crisis, provided the investor is positive towards US outlook.

Few reasons why soft dollar drives up share price:

- US export increased during weak dollar cycle. Good and services are more cheap and foreign company buy more US service and good. Company earnings-per-share projections will move up.

- Investor shifts their cash from bond investing to equity markets. It is the no-brainer that an investor will choose double-digit return on equity than a single digit return in bond. This behaviour is only come with a condition that the investor’s outlook towards the market is good and economic backdrop is stabilised and business friendly.

When will be the case where the soft dollar will not push up share price any further?

If the dollar fall in value is caused by lost confidence in government, an investor will flee away from the money market and buy other safer investments such as Gold, Euro and Cryptocurrencies.

It’s trying to become a digital gold in a digital global currency that will peg all these fiat currencies and basically hold all the governments behind the currencies responsible for their decision making and their debasement. So the idea of bitcoin is fairly simple but it’s application. And definitely, the technical side of it is anything but simple. The only difference between gold and Bitcoin are cryptocurrencies is that you can spend it with a smartphone instead of like actually having to deliver physical gold. — extract from theinvestorpodcast.com

Before 15 August 1971, where the dollar is still pegged with Gold, if anything happens to the US economy, the investor can change the dollar with gold and flee the country with the gold bar. (Bretton Wood International monetary system which effective 1944 – 1971). This free-floating make the dollar become a Fiat currency and which its weakness of lead to the innovation of cryptocurrencies today.

So for example when we look more recently like in the last credit cycle quantitative easing is something that the US Federal Reserve conducted for numerous years after the 2008 crash and all that was happening was the U.S. Fed was buying bonds off the market and putting the cash into the hands of the people that were selling them the bonds. So those sellers that were selling the bonds would then use the money for the economy and they’d take that liquidity and they’d buy some other some like some other asset or some other stock and that’s why you’ve seen the stock market go wild through all this. The problem with this approach is that it manipulates the markets so that they’re not free and open like they used to be. — extract from theinvestorpodcast.com

In short, there are no fixed rules apply. It depends on the market condition at the time and investor sentiment.

Feel free to express your view by comment below.